A campaign to slash VAT for tourism related business has been inundated with support.

Scores of business and political leaders have come forward to back a renewed push to reduce the VAT rate from 20% to 5%.

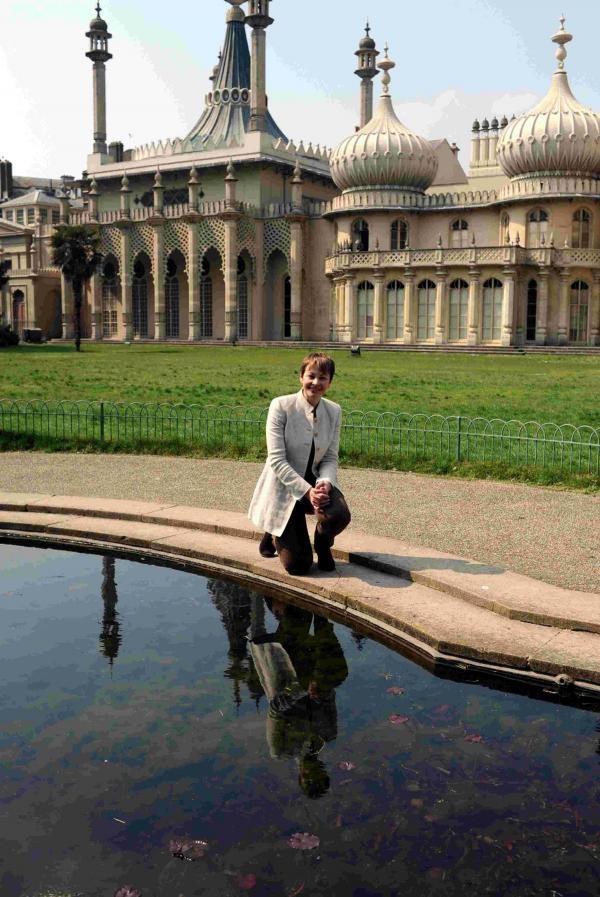

Brighton Pavilion MP Caroline Lucas has taken the fight to Parliament and sponsored an early day motion calling for a reduction for tourism-related businesses.

It follows a study which found tourism indirectly employed 38,000 people in the greater Brighton region and was growing faster than any other UK seaside town.

Some 300 businesses in Sussex support the campaign, which argues that the level of VAT creates a “competitive disadvantage” compared with European tourist destinations.

The UK is one of just three EU states which does not have reduced VAT for tourism, whereas in France a boost in investment and jobs has been found.

Meanwhile the Nevin Report, commissioned by the Cut Tourism VAT Campaign, say a cut would cost the exchequer nothing after four years and net £5 billion after 10 years.

Soozie Campbell, chairwoman of the Tourism Alliance, said other sectors could not deliver the same returns as tourism.

Money She said: “What is clear to me is that the Government stands to make more money for the Treasury.

“Tourism stands apart in that it impacts every single one of us, through leisure, attractions, hotels, restaurants, bars and cafes.

“To make this concession would immediately raise spirits, consumer confidence and spending to a degree that will start to permeate other sectors as well.

“And of course this would be great for Brighton as a tourist destination.”

Max Leviston, general manager of the Sealife Centre, said the results would be far-reaching.

He said: “The Laines would become even more prosperous, theatres would increase audience numbers, hotels and hostels would increase occupancy, restaurants would have more covers and visitor attractions would not be so reliant on the weather to drive the visitor numbers during peak trading periods.

He added: “This is not only about tax breaks and creating a level playing field, but it will increase employment within the city, and have many other benefits as well.”

The chief executive of Brighton i360 Ltd backed the campaign, arguing the UK had one of the highest levels of VAT in Europe.

Eleanor Harris added: “The tourism industry is now the UK’s fifth largest export earner, generating a whopping £24bn per annum for the UK economy.

“In Brighton it is worth an estimated £1bn per annum. Tourism-related employment accounts for 10% of the entire UK workforce and 14% in Brighton.

“Tourism is particularly good at tackling youth unemployment: on average 40% of the staff in tourism businesses are under 30 compared to just 19% in other industries.”

Jeremy Ornellas, proprietor of Blanch House, signed the petition calling for the reduction.

He explained: “With a cut in VAT equal to that of our European counterparts we would be able to compete much more effectively on price without compromising on standards.

“This would undoubtedly help increase the number of visitors.

“Brighton is heavily reliant on tourism, with this sector employing a high percentage of local people.

“With a reduction in VAT we would be able to invest in, recruit and train more staff which would provide young people with not only a job, but a sense of purpose and a fulfilling career.”

Simon Maguire, general manager of Hotel du Vin, said other sectors would stand to benefit from a reduction.

He said: “We compete not only with other towns in the UK but European destinations and this would offer even better value for money for customers.

“More importantly it’s a win-win situation as many other industries benefit from construction to transport to retail.”

It is not just directly tourist-related business calling for a change, with one restaurateur saying VAT was killing food businesses.

Karl Jones of Moshimo restaurant said: “Businesses like my own are working two days of the week just to pay VAT, and unlike other industries, we have nowhere to claim the VAT back.

“We are expected to pass on a whopping 20% in additional price to our customers to pay VAT.

“For me that’s thousands of additional little plates of sushi to cover VAT. It’s one of the main reasons why so many restaurants in Brighton fail.

“Too many conference bookings go over the water. You can be in Lille from London in 45 minutes.

“I know conference organisers who are saving £800,000-£120,000 a year doing just that.”

Nick Mosley, director of the Brighton and Hove Food and Drink Festival, said a reduction would make feel-good activities such as eating out or visiting the pub more accessible and put money into the economy.

He said: “A blanket reduction in VAT across hospitality and tourism would allow the sector to generate further employment opportunities, whilst keeping healthy price competition between businesses.

“It would also make the UK a more competitive choice for in-bound visitors.

“As tourism and hospitality are such an important part of the Brighton economy, the knock-on effects of a reduction in VAT would be a huge benefit our city, making it a better place for residents and visitors.”

Worthing West MP Peter Bottomley, Eastbourne MP Stephen Lloyd and Hove MP Mike Weatherley are among the 57 MPs to back the motion.

Meanwhile Andy Cheesman, boss of City Cabbs and Buddies cafe bar, Nick Pardo, director of Rendezvous Casino, and Tony Gibbons, managing director of the Noble Organisation, which owns Brighton’s Palace Pier, have leant their support to the campaign. However the Treasury remains so far unconvinced by the arguments, saying VAT cuts would lead to a “significant revenue shortfall”.

A spokeswoman said: “The government recognises the importance of the tourism and hospitality industry, and is providing additional support to businesses in a number of ways.

“For example, from April 2014 businesses and charities have been able to benefit from up to £2,000 off their employer national insurance contributions bill and over £1billion of business rates support has been provided, benefitting all ratepayers.

“While we keep all taxes under review, we do not have any plans to introduce a VAT cut for tourism.”

Comments: Our rules

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused.

Please report any comments that break our rules.

Read the rules hereLast Updated:

Report this comment Cancel