HOUSE prices in Brighton and Hove continue to grow as it is becoming even harder for first-time buyers to get onto the property ladder. HENRY HOLLOWAY reports on the city’s housing market which is fast becoming a “mini-London”...

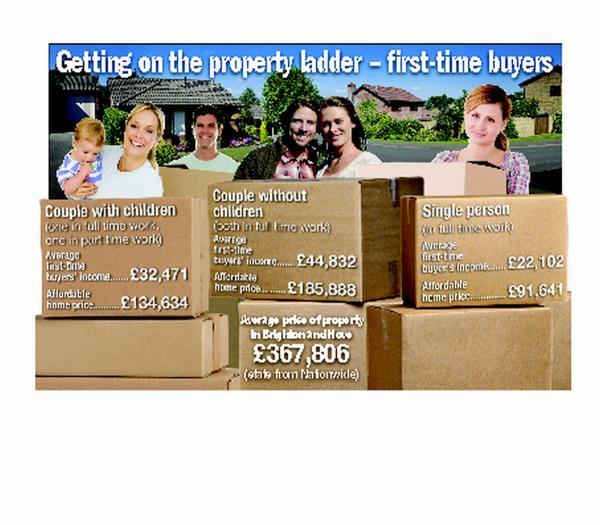

IN the last quarter alone, house prices in Brighton and Hove have grown by 13% – driving the average price in the city to £367,806.

According the report by Nationwide published this week, that is nearly twice the national average, which currently sits at £186,544.

This quarterly growth seems to continue the trend, as the previous quarter also saw a growth of 14% in the prices of houses within the city.

With prices constantly growing it is becoming harder and harder for people to get a foot on the housing market.

Statistics published by housing charity Shelter show that out of 1,045 two bed or more properties in the city only one could be deemed as affordable to an average family – this works out to just 0.1 per cent of homes on the market.

Single people did not fare much better, with only three affordable one-bed properties in the city.

Couples without children had broader options in Brighton - with 21 properties being affordable, but this still only 2.0 per cent of the two-bed housing stock.

Shelter said the city and the wider region as being in a “drought of affordable homes”.

The statistics were worked out by adjusting average earnings to reflect lower ages of first-time-buyers and comparing them to house prices.

All properties which listed the number of bedrooms as zero were excluded – which removed some studio flats from the data.

Campbell Robb, chief executive of Shelter, said: “When a family looking to buy their first home searches a whole town for a place to live and finds nothing they can afford, it's clear we’re not just facing a housing shortage any more: it’s a full-blown drought.

“As the pool of affordable properties shrinks ever smaller, thousands of people are being forced to wave goodbye to their dreams of a home of their own – even those who’ve been able to put aside a large deposit. It’s a bitter pill to swallow when we know that politicians can turn the tide on our housing shortage in a single parliament.

“Our failure to build more homes is leaving a whole generation of young people with no choice but to remain trapped in expensive and unstable private renting, or stuck in their childhood bedrooms for years to come, no matter how hard they work or save.

“The only way to bring house prices back within reach is to fill the gap between the homes we have and the homes we need.

“Help to Buy or tweaks to planning rules will only ever be sticking plaster solutions.

“Bringing a stable home back within reach will take bolder action like helping small local builders to find the finance they need to get building, and investing in a new generation of part rent, part buy homes.

“What we need right now is for politicians to roll up their sleeves and make stable homes for the next generation a top priority.”

Estate agents have called Brighton and Hove a “mini-London” when it comes to the cost and demand for housing.

Jason Brand, president of Brighton and Hove Estate Agents Association and of Brand and Vaughn, said: “It is widely acknowledged there are two property markets in the UK, London and the south east, and the rest of the UK.”

He said the average age of first time buyers who did not borrow money from their parents was now sitting in the late thirties.

Mr Brand added the housing market in the city is a very difficult problem to solve.

He said: “I think the solution is a very difficult one – an interest rate rise is not going to sort it out as the rest of the UK does not need it.

“There is no magic way of solving it unless you can tie interest rates to postcodes – but that is never going to happen.

“There has been a slight cooling in the market in London, but Brighton is still very busy.

“You would naturally think it would may slow down towards the winter period – but who knows? In the last two days we have exchanged nine properties – that is record numbers.”

He added while some properties went to local people the majority were sold to people from out of the city.

Andy Lees, partner in Graves Son and Pilcher, said: “Nowadays the property market is far more transparent and people are aware of its limits and as a result tend not to put their own on the market.

“That of course brings it back to the old supply and demand routine and that leads to many properties achieving a higher price.

“What does not help is the government’s new take on buy to lets and they are not making it easy for people looking to owner occupy.”

Danny Ross, manager at Baron Estates, said: “Shelter’s statistics do not surprise me, they are worrying, but not surprising.” Paul Bonett, Brighton member of the National Association of Estate Agents, called rising property prices a “paradox”.

He said: “The problem with Brighton and Hove is that it’s a very desirable place to be.

“The Brighton scene and it’s vicinity to London, along with its popularity with students, is helping to drive up prices.”

He added: “Brighton is like a mini London and is comparable to Oxford and Cambridge, they have big student populations and high amounts of rentals.”

Caroline Lucas, MP for Brighton Pavilion, slammed the state of the market saying house prices in her constituency were twice the norm.

She said: “It’s just not good enough that Brighton and Hove is effectively off limits to the vast majority of would-be first time local buyers.

“In my constituency, house prices are double the national average – with a knock-on effect on private rents, which are also double the norm in Brighton Pavilion.

“The problem is made even worse by the Government’s cuts and successive government’s failure to invest in new affordable and council housing.

“So I’m delighted Shelter is calling on the Government to get a reality check and build more affordable homes.

“The situation has to change. That’s why I questioned the Prime Minister about it on Wednesday, it’s why I questioned Labour shadow ministers and it’s exactly what my Housing Charter – compiled from the experience of hundreds of local residents – addresses.”

Andy Winter, chief executive of the Brighton Housing Trust, said: "It comes as no surprise to me that just 0.1 per cent of homes are affordable for first time buyers in Brighton and Hove.”

Brighton and Hove has long been an attractive prospect for Londoners wishing to cash in on property prices in the capital.

“As a result, demand for housing from relatively wealthy Londoners, students remaining after graduation, and local people, has created an over-heated housing market where just the better off can expect to thrive.”

Councillor Bill Randall, Chair of Housing Committee, said buying a home was “beyond the means of almost all of the city’s sons and daughters”.

He said: “Private sector rents are soaring beyond the pocket of many people and housing associations no longer provide for those on low incomes.

“Tory housing policy has failed our city. We urge the Government to allow local authorities like Brighton and Hove to borrow to build more homes for rent and for part rent and part buy.

“We have identified sites across the city and are working up plans for new homes in partnership with housing co-ops and self-builders.

“Some of the sites are very small and will yield only one or two homes, but every scrap of land is important in a city so short of space and so full of people.

“In the longer term, the city’s housing problems will be solved only by building across the wider city region.”

• Consequences of rents

WHILE the housing market can often provide baffling statistics, the effect it has on people’s lives is very real.

Some people are finding it impossible to get their feet onto the property ladder and are being forced into renting.

Brighton has one of the biggest rental markets outside London - fuelling problems with so-called “Generation Rent” which The Argus has previously reported on.

One woman called Sasha, who wished to remain anonymous, is a single working mum living in Brighton who has been forced to rent as she cannot afford to buy her own home.

With her baby boy she has been seeking a one-bedroom flat to rent – which was all she could afford in the city.

Even though Sasha has the means to rent privately, the barriers she's faced from the private rental sector left her “terrified” and contemplating the possibility of having to make a homelessness application.

She said: “I can't afford two bedrooms, although I’d obviously love to be able to.

“I believe this issue must be a wider one in the city.

“We need more than ever to try and break down barriers to accessing the private rented sector.”

• Working 3,609 hours to afford a deposit

AN online estate agent carried out a report which found that house buyers in Brighton will work an average at least 3,609 hours before they can put down a deposit.

Their report also states buyers would have to work 18,048 hours before they could afford to outright buy their own homes.

The average hours worked was calculated assuming the average full-time worker is paid for 37.5 hours of work a week and gets 25 days holiday.

Deposits were calculated as 20% of costs of property based on figures from the land registry.

This stat pales in comparison to London however while buyers in London having to work up to 9,000 hours.

Russell Quirk, eMoov.co.uk founder, said: “Buyers really have their work cut out just to pay for a deposit these days.”

Comments: Our rules

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused.

Please report any comments that break our rules.

Read the rules hereLast Updated:

Report this comment Cancel