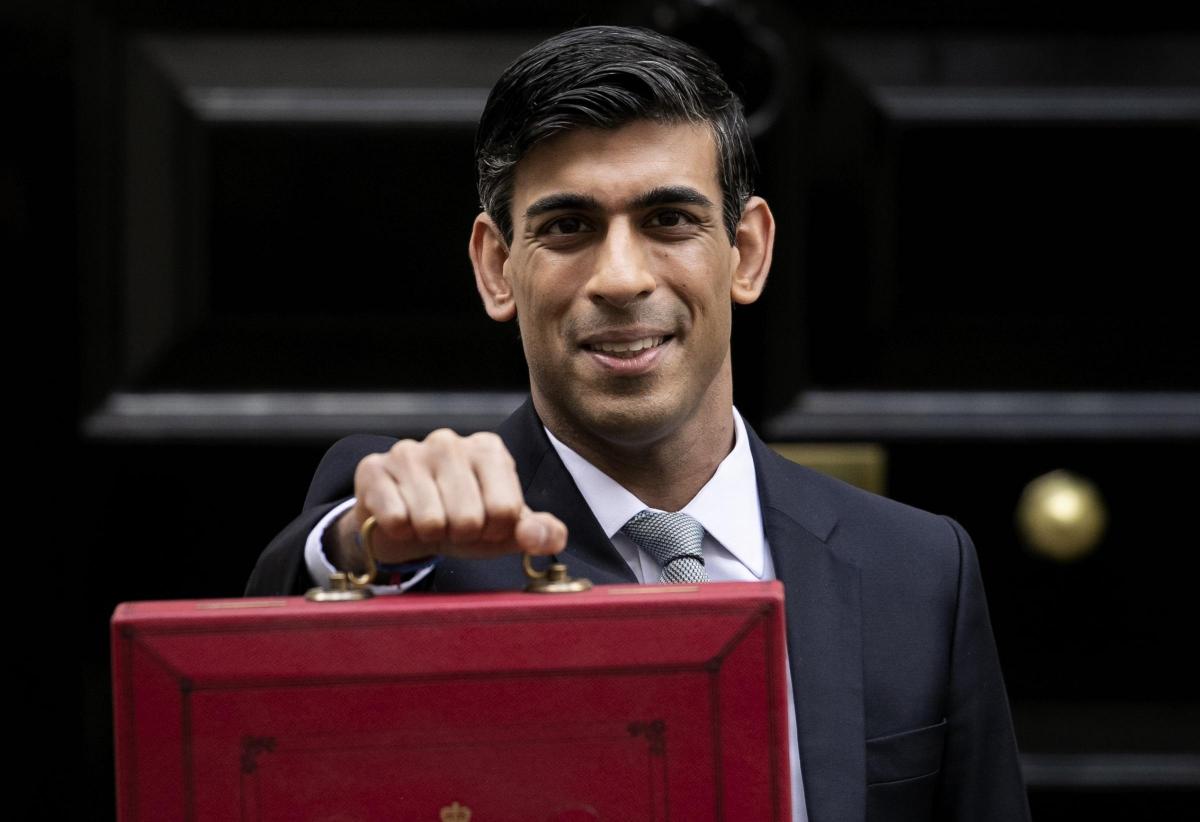

RISHI Sunak has delivered a Budget which set out billions of extra spending to help the economy through the coronavirus crisis – but then massive tax hikes to pay for it.

The economy

The Chancellor said coronavirus has caused one of the “largest, most comprehensive and sustained economic shocks this country has ever faced”.

The Office for Budget Responsibility (OBR) is now forecasting “a swifter and more sustained recovery” than they expected in November, predicting the economy will be three per cent smaller than it would have been in five years’ time because of the coronavirus crisis. But the economy, according to the OBR, is forecast to grow this year by four per cent, by 7.3 per cent in 2022, then 1.7 per cent, 1.6 per cent and 1.7 per cent in the last three years of the forecast.

Borrowing is forecast to be £234 billion next year – 10.3 per cent of gross domestic product (GDP), a measure of the size of the economy – but will fall to 4.5 per cent of GDP in 2022-23, 3.5 per cent in 2023-24, then 2.9 per cent and 2.8 per cent in the following two years. The measures to support the economy amounted to £65 billion over this year and next, taking the total government support to £407 billion over that period, Mr Sunak said.

Coronavirus support

The furlough scheme will be extended to the end of September, as will support for the self-employed.

The Universal Credit uplift of £20 a week will continue for a further six months, well beyond the end of this national lockdown.

A new restart grant will start in April to help businesses reopen, with £5 billion of funding.

The Chancellor confirmed an additional £1.6 billion for the coronavirus vaccine rollout and to “improve future preparedness”.

The business rates holiday for the retail, hospitality and leisure sectors will continue until the end of June, and will be discounted by two thirds for the remaining nine months of the year. The five per cent reduced rate of VAT for the tourism and hospitality sector will be extended for six months to the end of September, with an interim rate of 12.5 per cent for another six months after that.

The stamp duty cut will continue until the end of June, with the nil rate band set at £250,000 – double its standard level – until the end of September.

A Recovery Loan Scheme will replace previous coronavirus loan packages, allowing businesses of any size to apply for loans from £25,000 up to £10 million through to the end of the year, with the government providing lenders with an 80 per cent guarantee.

Taxation

The rate of corporation tax, paid on company profits, will increase to 25 per cent in April 2023 – but small businesses with profits of £50,000 or less will continue to be taxed at 19 per cent. There will be a “super deduction” for companies when they invest, reducing their tax bill by 130 per cent of the cost for the next two years.

Rates of income tax, national insurance and VAT kept at the same level but personal tax thresholds will increase next month and be maintained at those rates until April 2026.

The inheritance tax threshold and the pensions lifetime allowance will be maintained at their current levels, along with the annual exempt amount in capital gains tax, until April 2026 and, for two years from April 2022, the VAT registration threshold.

Other announcements

The minimum wage will increase to £8.91 an hour from April. On apprenticeships, the government is to double the incentive payments given to businesses to £3,000 for all new hires, of any age.

All alcohol duties are frozen for the second year in a row and the planned increase in fuel duty is also cancelled.

A “mortgage guarantee” was announced, with lenders who provide mortgages to homebuyers who can only afford a five per cent deposit benefiting from a government guarantee on those mortgages.

The UK Infrastructure Bank will be located in Leeds, while the Treasury is to establish a new economic campus in Darlington.

Freeports – “special economic zones with different rules to make it easier and cheaper to do business” – will be located at East Midlands Airport, Felixstowe and Harwich, the Humber region, the Liverpool City Region, Plymouth, Solent, Thames and Teesside. There was more funding for the devolved administrations, with £1.2 billion for the Scottish government, £740 million for the Welsh government, and £410 million for the Northern Ireland Executive.

Comments: Our rules

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused.

Please report any comments that break our rules.

Read the rules here