THE daughter of a multi-millionaire Sussex entrepreneur has been jailed over a £500,000 tax fraud.

Theresa Bunn, 56, third child of the late Douglas Bunn, was sentenced to two years and eight months after lying about the value of her aunt’s estate.

She told HMRC that Diana Vivien Pares-Wilson had left about £285,000 when, in fact, the estate was worth more than £1.5 million.

The Argus understands she lived with her maternal aunt for several years in Henfield and was the executor of the will.

Stuart Taylor, assistant director for HMRC, said she had “the benefit of large amounts of cash” and “lied purely to avoid tax”, adding: “The vast majority of us pay what is due, when it is due.”

HMRC said it starting investigating her finances after officers discovered she had been financially supporting a friend in Wales, using the friend’s bank accounts to hide money and evidence of spending from her family.

Bunn’s father, who died in 2009 at the age of 81, was the founder of holiday village Bunn Leisure, based in Selsey, a multimillion-pound business now run by one of his sons.

His Hickstead showjumping course, also now run by his children, seats more than 5,000 spectators and hosts the prestigious FEI Nations Cup.

By pretending the value of her aunt’s estate was below the threshold for inheritance tax, currently £325,000, Theresa Bunn avoided a tax bill of about £500,000 after her aunt’s death in Worthing in February 2010.

HMRC said she also confessed to failing to declare substantial gifts from her aunt while she was alive.

On April 3 last year, she was charged with cheating the Public Revenue contrary to Common Law, and pleaded guilty to the offence on March 9.

She was jailed the next day by Judge Christopher Parker QC at Chichester Crown Court and is likely to be eligible for release next March.

HMRC said she had been summonsed to interview from her latest home in Kilgarvan, County Kerry, Ireland. Before that she had lived in Cuckfield Road, Hustpierpoint, after her aunt went into care.

Her half-brother Edward Bunn, who co-runs Hickstead now, told The Argus on behalf of the Bunn family: “We are very sorry to see our sister in this position.

"This is purely a personal matter. She has no connection with any of the Bunn Family businesses and never has had.”

HMRC has been cracking down on inheritance tax fraud in recent years, increasingly trying to close loopholes on tax avoidance schemes.

Mr Taylor said: “HMRC will not tolerate tax fraud and will investigate those we suspect of operating outside the law.”

Eccentric pair lived in modest home not far from Hickstead

HER father was a millionaire whose flair for business and force of personality propelled him from fruit-seller’s son to showjumping pioneer, married three times and fathering ten children.

Yet despite his wealth and a name that could open doors, Theresa Bunn approaches her sixties alone, behind bars after being caught out lying for the sake of £500,000.

The third child of Mr Bunn’s marriage to first wife Rosemary Pares-Wilson, Ms Bunn never joined many of her seemingly self-assured siblings in working for the family businesses.

Many years after her parents’ marriage ended, she went to live with her mother’s sister, Diana Pares-Wilson, in a modest home in Henfield, about six miles from the renowned showjumping course her father founded in Hickstead.

Some who knew the pair said the unconventional set-up in a quiet, comfortable street was one of mutual convenience, providing a home for Ms Bunn and a companion and sometime carer for her ageing aunt.

The duo were remembered as “eccentric” by neighbours, with one recalling Ms Pares-Wilson hollering for products from the chemist through her car window.

They were sometimes seen together at the upmarket Wickwoods Country Club or Theresa would be seen walking up the road with a book in her hand.

One neighbour recalled Theresa, now 56, as a keen cook who sometimes cooked for parties in London. Both were “likeable”, neighbours said, while some described Ms Bunn as “vulnerable”.

“I feel very sorry for her now,” one neighbour added. “I am not sure how well she will manage with being in prison.”

Aunt and niece lived in the detached house in Henfield until about 2008, after which the increasingly frail Ms Pares-Wilson went to live in care in Worthing and Theresa moved to Cuckfield Road, Hurstpierpoint.

Whatever the vagaries of their relationship, Ms Pares-Wilson entrusted her niece with distributing her £1.5 million estate after she died in 2010, asking for it to be divided between her, siblings Lavinia and Claudia, and other family members.

Her aunt also named another friend as co-executor, but it is understood she stepped down and Theresa was left to handle the matter. She lied to the authorities about the value of the estate and embarked on an elaborate scheme to hide money from the taxman and apparently from her family, putting cash into a friend’s bank account in Wales.

Although that may have saved her a bill of about £500,000 to start, it soon pushed her into the increasingly wide net of HMRC, which has made significant noises of late about clamping down on inheritance tax fraud.

Whether they were tipped off the agency did not say, but its investigators soon became aware of the money.

Theresa had moved to a remote farmhouse in County Kerry, Ireland, and it is there an HMRC summons would have landed on her doormat.

After pleading guilty to cheating the public purse, she was given a custodial sentence at Chichester Crown Court.

It is a life trajectory at odds with that of her Cambridge-educated father, who turned a patch of marshland near Chichester into the largest holiday village in Europe.

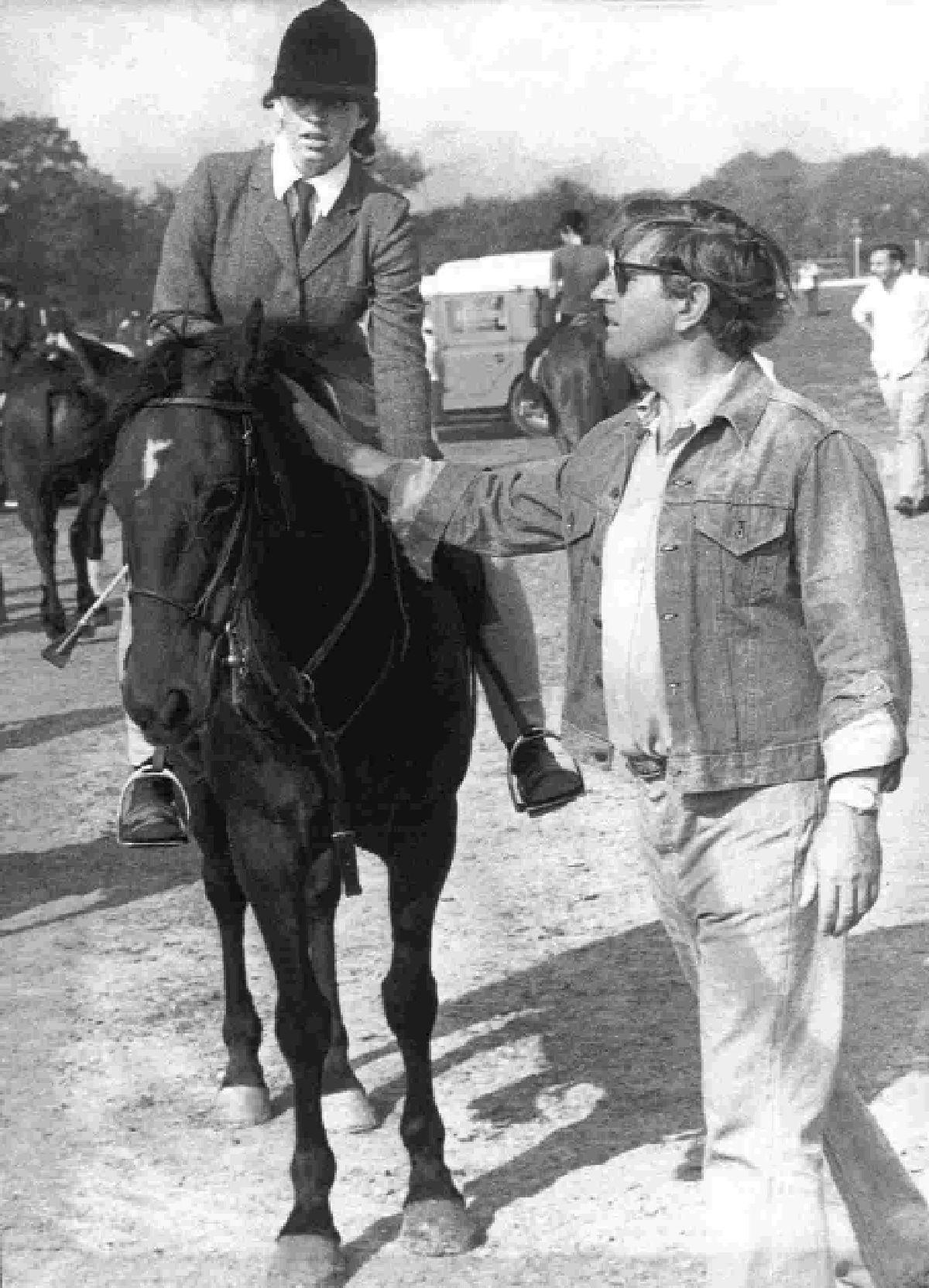

That business helped him generate the cash to follow his love of horses and develop the All England Jumping Course at Hickstead, which he set up in 1959.

Widely regarded as the home of British showjumping, the course also hosts dressage and polo events and, since 1971, has hosted the FEI Nations Cup, a major international showjumping event.

A top-level show-jumper himself, Mr Bunn determined to make his course the best in Europe, building a terrifying 10ft 6in Derby Bank to pip one in Hamburg.

Starting his career as a barrister, he was known for turning up to court in riding gear, adding to his lasting reputation as a colourful and determined figure, whose death was widely mourned.

Today, Hickstead and Bunn Leisure are run by Theresa’s younger half-siblings. Edward and his sister Lizzie run the equestrian showground while their brother John is in charge of the holiday village in Selsey.

If Theresa’s crime has caused a rift in the family they did not say; her siblings this week said simply they were “sorry” for her. “It is very sad,” added her elder sister Lavinia, declining to comment further.

Her mother, now Rosemary Greenwell, also went on to remarry and now lives near Amberley Castle – a very different view from the one her daughter now faces for at least the next year.

From son of a fruit-seller to pioneer of showjumping

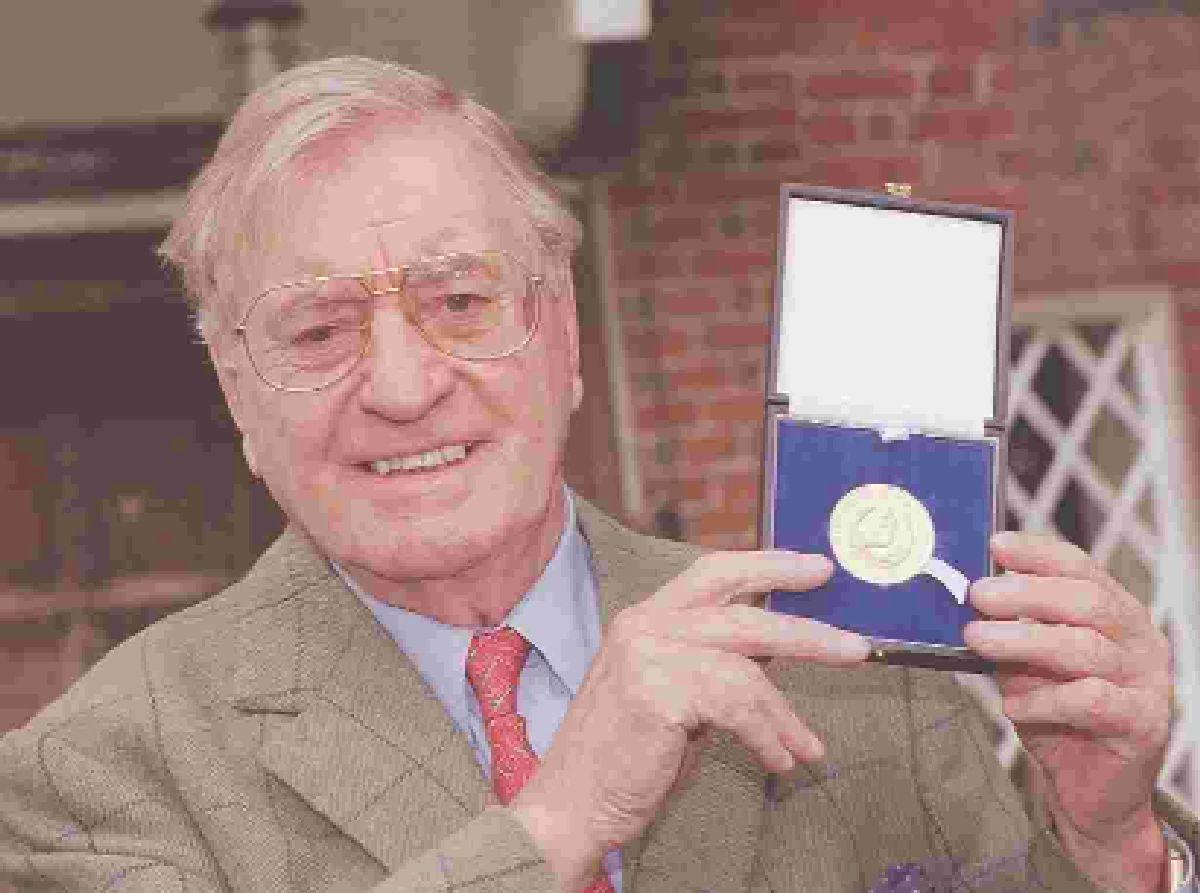

Douglas Bunn was a larger-than-life, self-made man, who was in and out of the gossip columns and hugely respected for his contribution to showjumping.

In the 1950s, he bought 20 acres of land from his father in Selsey, near Chichester, known as Pidney’s Marsh.

He developed it into the largest independent holiday village in Europe.

Bunn Leisure can have more than 12,500 people staying on a busy weekend, employs more than 300 full-time staff and says it generates £54 million for the local economy.

However, Mr Bunn’s main passion was showjumping and, in 1959, he bought Hickstead Place manor house, with the aim of setting up Britain’s first permanent showjumping arena.

Since 1960, most of the great and the good in the showjumping world have competed at Hickstead, which hosts the Equestrian.com Hickstead Derby Meeting and the Longines Royal International Horse Show In 1974 Mr Bunn – known as Dougie – invented ‘team-chasing’, a new equestrian sport which soon became a favourite of the Prince of Wales and the Princess Royal.

He was chairman of the British Showjumping Association in 1969, from 1993 to 1996, and president from 2001 to 2005, dying in 2009 after a short illness.

Michael Clayton, a past editor of Horse and Hound, paid tribute to Mr Bunn as “undoubtedly the greatest innovator in British showjumping in the post-war years”.

“He succeeded in creating his personal vision virtually on his doorstep at Hickstead – and he made the horse world come to him in his native Sussex,” he added.

HMRC gets tough on tax avoidance

TAX authorities have been trying to get tough on inheritance tax-dodging in recent years, and it appears Theresa Bunn walked straight into their net.

As the rules stand, money or possessions left behind after death are taxed at 40% if they are worth more than £325,000 in total. That can be reduced to 36% if 10% or more of the estate is left to charity.

Inheritance tax may also be payable on gifts a person makes during their lifetime, especially if they die within seven years.

Married couples and civil partners can leave assets to each other tax-free Inheritance tax is usually paid from the estate, and it is up to the executor or administrator of the will to pay it within six months. HMRC estimates about £400 million of inheritance tax payments are not paid, or 12 % of the total due.

Comments: Our rules

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused.

Please report any comments that break our rules.

Read the rules hereLast Updated:

Report this comment Cancel