A £1.5million-a-year increase in business rates will kill off the city’s independent pubs, industry experts have warned.

Today, The Argus reveals for the first time the scale of the financial crisis facing Brighton and Hove’s pub trade.

A Freedom of Information request shows 189 of the city’s pubs will face a combined annual increase of nearly £1.5 million. Nearly 40 of those will see their taxes double.

Cash-strapped landlords called the rise “unsustainable” and dismissed the £1,000-a-year handout to small pubs announced in last week’s Budget as “a joke.”

Ben McKellar, landlord of the Ginger Dog, in College Place, will see his business rates increase nearly fourfold.

He called the rise “ludicrous” adding: “It’s a disaster for us. This will definitely cause small businesses to close. It’s the difference between making money and not making money and if you don’t make money you close.

“Jobs are going to be hit, and there will be closures because this isn’t sustainable.”

Business rates are the commercial equivalent of council tax, although they are set by central government and not exclusively spent locally.

Rates are paid at around 50 per cent of the “rateable value” of a property, as set by a government assessment.

Rate changes based on a recent revaluation will come into force on April 1, and many businesses are facing enormous increases.

In the Budget last week, the Chancellor announced a £1,000 relief payment for smaller pubs but Mr McKellar called the gesture a joke.

He said: “If you put up rates by £30,000 and give back £1,000, what’s the point?”

Martin Swindon, finance director of The Laines Pub Company, which owns pubs including The Mesmerist, in Prince Albert Street, and the North Laine Brewhouse, in Gloucester Place, said his firm was facing a rate rise of £400,000.

He said: “We’re a bigger business so we can absorb these increases but for some independents they’re going to have to close.”

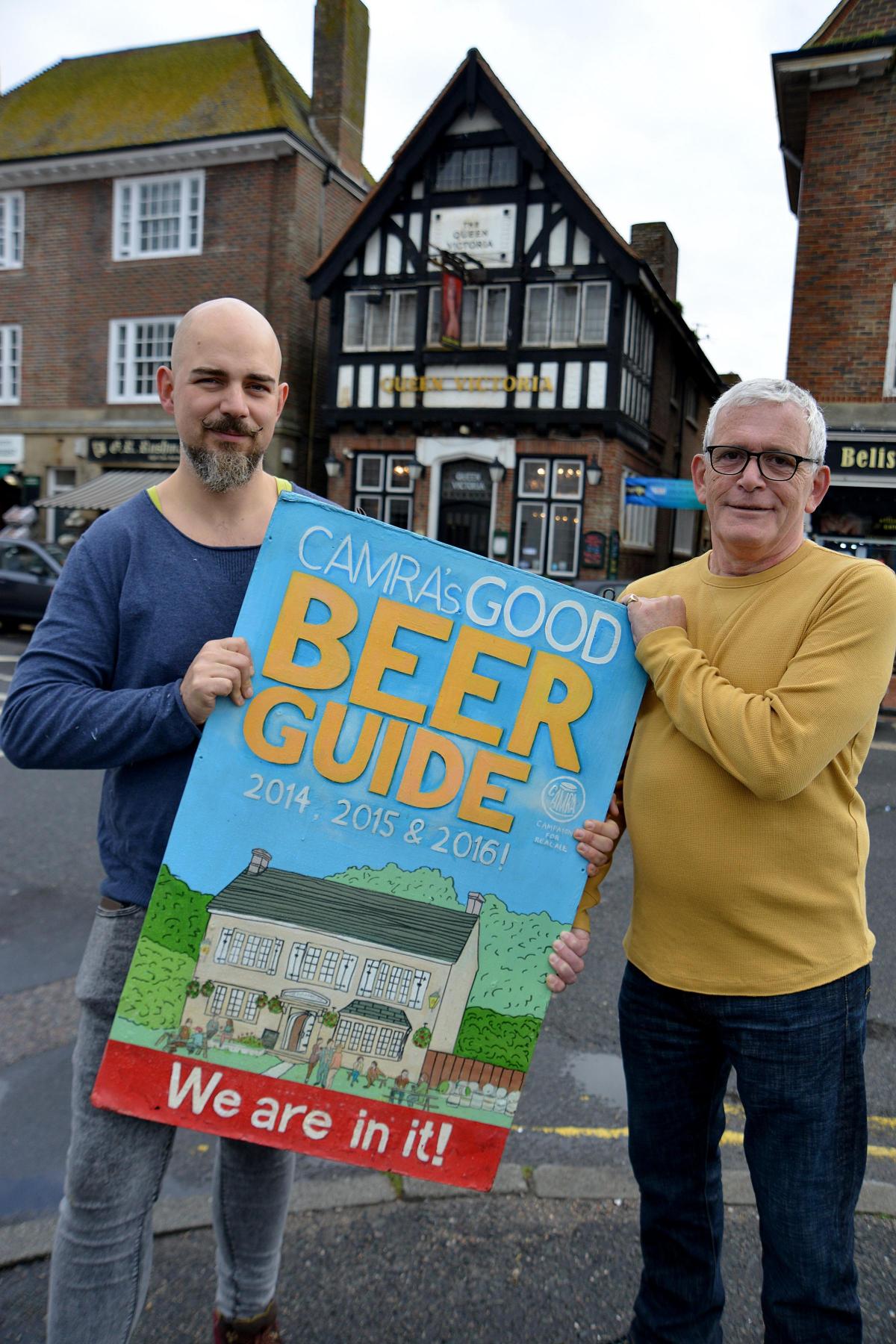

Philip Rees, landlord of the Queen Victoria, in High Street, Rottingdean, has been told he will receive “transitional relief” so the full impact of the 120 per cent increase to his rates will not kick in until next year.

But, he said: “We’re going to be absolutely clobbered. I don’t know whether we would have closed but it would have made things so challenging. I find it hard to say how we would have found a way through.”

Jen Dalby of the Hand in Hand pub in Upper St James’s Street, will see her rates double. She said: “I can’t take any more money, even if I run flat out. Pubs will close if they get increases like this.”

JOBS ARE GOING TO BE HIT – THERE WILL BE CLOSURES

FROM the landlords of tiny locals, to the directors of major pub chains, the city’s pub bosses are staring down the barrel of tax increases amounting to £1.5 million per year.

They say rate rises will cost jobs, force publicans out of business, damage the economy and undermine communities .

Many ask why taxes have shot up when their business has not changed since the property valuation in 2008. And some complain this is a tax on investment.

Martin Swindon, finance director of The Laines Pub Company which owns Brighton pubs including the North Laine Brewhouse, said: “We’ve been penalised for investing in our sites. We spent £700,000 on the North Laine in 2010. Prior to that it was a derelict site. We had to spend money on it, and by spending that the revenue has gone up and now the rates have gone up by £40,000 a year. That’s madness.

“And people don’t realise that’s a cash cost – that’s straight off the bottom line.”

He warned smaller firms would close.

He said: “For a lot of businesses its a lifestyle business, and people live above the pub. When you start taking six or ten thousand out of that, it doesn’t work.

“I know people who are earning £25,000. They’ll now be on £12,000 and they’ll say, ‘I might as well be on the dole’. It’s going to kill a lot of the small businesses, it really is.”

He added: “It will have a major effect on the economy. It’s about jobs that won’t be offered, and reinvestment that won’t be undertaken, no doubt about it.”

Ben McKellar, who owns the Ginger Man Group, is facing the single biggest rise of any pub in the city, with the rateable value of the Ginger Dog in College Place revalued from £15,750 to £74.500.

That means rates will increase from around £7,000 a year to £34,000.

Mr McKellar said: “That’s the cost of two members of staff. That’s the difference between making money and not making money. So you’ve either got to put your prices up, which no one wants to do, or you open longer – and we’re already open seven days a week – or you employ fewer people.

“I think jobs are going to be hit. I think there will be closures, because this isn’t sustainable.”

Jen Dalby owns The Hand in Hand in Upper St James’s Street, Brighton.

Her rates will more than double, although she will benefit from so called transitional relief, meaning she will not pay the full amount of the new cost in the first year.

She said: “When I got the letter I thought, ‘that’s not that bad’ but when you start to go through it, it’s really horrible.

“I’m very angry, I’m in shock. We’re a tiny pub, I can only fit 55 people in, there’s no garden, we don’t serve food. I can’t take any more money. Even if I run flat out I can’t do it.

“Pubs are going to close if they get increases like this and it shows a lack of understanding that pubs are social centres. This is a lifeline for some people and I’m worried about my regulars.”

Philip Rees, landlord of The Queen Victoria in Rottingdean, said rates were not the only tricky card Chancellor Philip Hammond has dealt the industry.

He said: “The increase in rates has to be seen in the context of the increase in duty. There is no opportunity to increase prices to pay for rates, because the prices have to go up anyway.

“There’s only so much blood in a stone, and I think the Government has bled this stone bone dry.”

WHAT THE FIGURES REVEAL

A FREEDOM of Information request obtained by The Argus found there are 248 properties in the city described by the government’s Valuation Office as a “public house,” of which 189 are facing an increase in rates.

Thirty-nine will see their rates double or worse.

Working out the total rates payable is not an exact science because the data does not include details on those few properties which are vacant (and therefore subject to almost total rate relief) or occupied by small businesses, and therefore subject to small amounts of rate relief.

A further complication is the sliding scale of the business rate “multiplier” which for financial year 2017/2018 is 46.6 per cent for a small business or 47.9 per cent for a standard business.

However, we know the combined rateable value of the 248 public houses from the previous valuation – carried out in 2008 and applicable from 2010 through to 2017 – was £9,499,000.

The new total, based on the 2015 valuation which comes into force from April 1 this year, is £12,556,000.

That is an increase of £3,057,000, which multiplied by approximately 47 per cent, is £1,436,000, or about £1.5 million a year.

The data also highlights winners and losers.

The Ginger Dog, in College Place, suffers the sharpest rise – 373 per cent.

The Hobgoblin, in London Road, The Constant Service, in Islingword Road, the Lion and Lobster, in Sillwood Street, and the Camelford Arms, in Camelford Street, all have owners looking at rate bills triple what they were.

Meanwhile, 55 pubs will get a cut in rates including The Marlborough in Princes Street.

Simon Kirby, Conservative MP for Brighton Kemptown, said the government had listened to the concerns of business and the Budget contained a £435 million package of relief and assistance.

Green MP Caroline Lucas called for the government to look again at the increases to protect the city’s “thriving pub scene”.

Comments: Our rules

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused.

Please report any comments that break our rules.

Read the rules hereLast Updated:

Report this comment Cancel