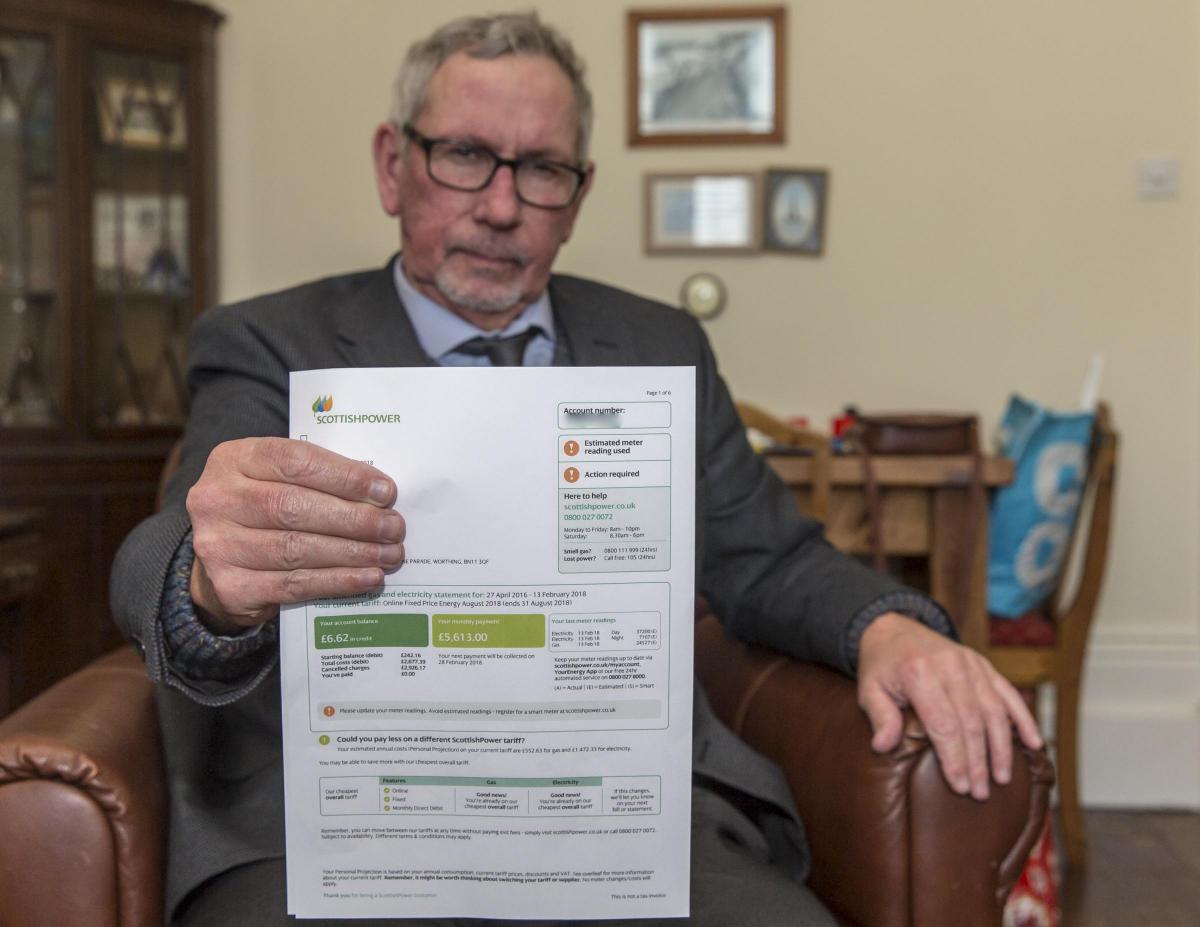

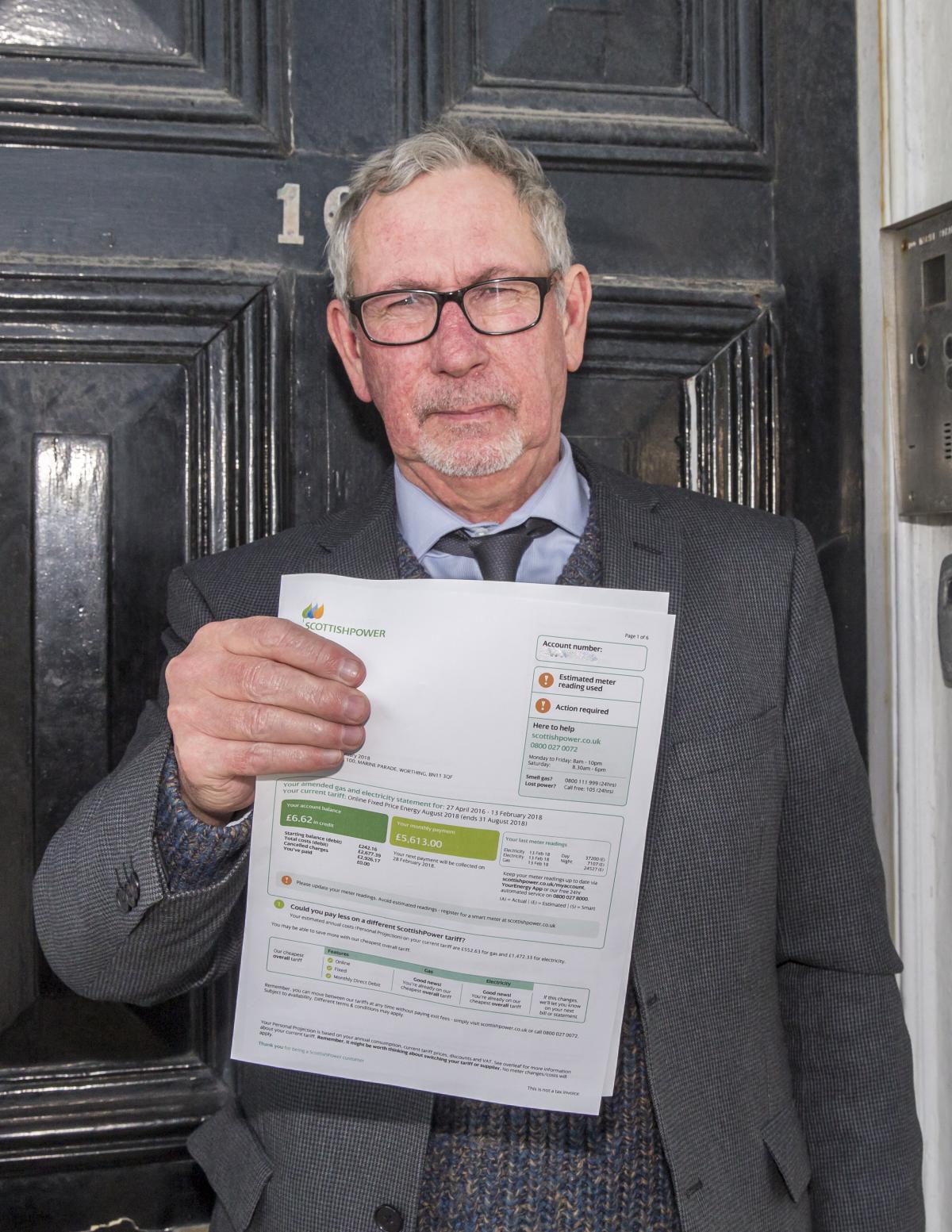

A TEACHER had the shock of his life when he discovered more than £5,000 had been mistakenly taken out of his bank account by Scottish Power.

Paul Kevern, 64, was further horrified when his bank refused to give it back.

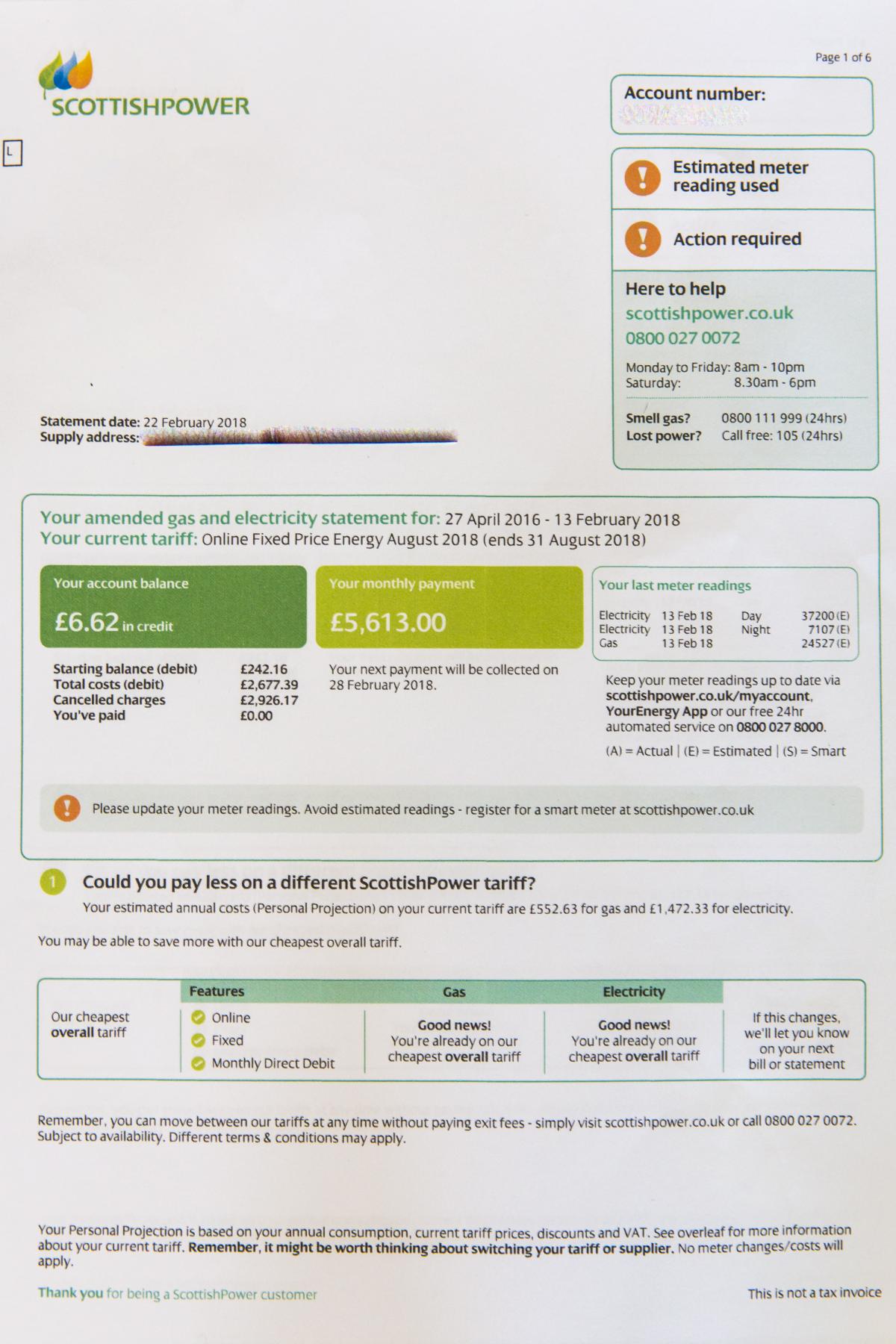

Mr Kevern was appalled to find his energy supplier had taken £5,619.62 from his account by direct debit for his monthly energy bill.

Despite Scottish Power acknowledging the mistake, he struggled to get his bank Lloyds to give him the money back.

Mr Kevern, of Marine Parade, Worthing, said: “From February 28 for three weeks Lloyds refused to process the indemnity and were charging me £10 a day in overdraft fees.

“I went into the branch and showed them my account with Scottish Power and showed them I was in credit.

“The energy company wouldn’t send me a bank transfer or a cheque – because it was part of the direct debit guarantee it had to go through the bank.

“But Lloyds wouldn’t do it.

“I was basically lending Scottish Power five grand as an unsecured loan as far as I could see.

“Apparently they did investigations by calling somebody at Scottish Power who then said there was a dispute and as soon as they heard the word dispute the bank said they could not give me my money back.

“But there was no dispute.

“If I rang Scottish Power they acknowledged it was a mistake.

“They said ‘you’re not running the biggest cannabis farm in Sussex, there’s no way you could use that much power in four years let alone one month’.”

Meanwhile Mr Kevern was left overdrawn and unable to pay his mortgage.

Describing the stress it caused him and his wife Margaret, Mr Kevern said: “I had to drive to school in Brighton every day and it was getting to a stage where I could no longer get fuel on my debit card as Lloyds made me overdrawn and were charging me £10 for the privilege.

“I was getting bounced mortgage cheques when I was the innocent party.

“It caused a lot of stress, I couldn’t stop thinking about it at work.”

It was not until The Argus intervened that Lloyds Bank finally agreed to give Mr Kevern his money back on Wednesday, three weeks after the issue arose.

A Lloyds Bank spokesman said: “We apologise to Mr and Mrs Kevern for the delay in refunding their payment and the inconvenience this has caused.

“This was due to a manual error when initially supporting them with their direct debit indemnity claim which has now been rectified.”

Mr Kevern said: “The banks have become faceless.

“When he was a bank manager my dad used to to know all his customers. Now everything is done in London and they have not got a clue who you are.

“I think there is a systemic problem with the procedure.

“They should put the money back into your account and it should be up to the company if they have a complaint to convince Lloyds they are entitled to the money, not the other way round.

“I went to the regulator Ofgem and the financial ombudsman, but it was The Argus that was the catalyst for speeding this up and they have done a good job.”

A spokeswoman for Scottish Power said: “We have apologised unreservedly to Mr Kevern for the human error which led to over-billing and the inconvenience this has caused.

“We understand he has now been fully reimbursed.”

Comments: Our rules

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused.

Please report any comments that break our rules.

Read the rules hereLast Updated:

Report this comment Cancel